Assurant Renters Insurance Loss Of Use

A renters insurance policy can help cover the expenses up to your limits to help replace your personal property and help you with temporary living expenses if your apartment is damaged by a covered loss and you cannot stay there. Renters insurance loss of use coverage can be a real lifesaver when you suffer a significant loss.

Renters Insurance Policy Free Quick Quote Assurant

A renters insurance policy deductible usually costs either 500 or 1000 out of pocket when you file a claim.

Assurant renters insurance loss of use. You can learn more here. The organizations that are able to help after a fire loss for example might only be able to give you three days in a hotel. Your also provides you with additional living expenses to protect you from extra costs if you have to leave your home.

Get a fast free quote from a leading insurer now. What Is Loss of Use Coverage. Renters Insurance is one of the most effective ways to protect yourself and your belongings.

In all states except Minnesota and Texas renters property insurance and renters liability insurance programs are underwritten by American Bankers Insurance Company of Florida with its home office in Miami Florida. What is loss-of-use renters insurance. Renters Insurance is one of the most effective ways to protect yourself and your belongings.

Thats probably not sufficient time to recover from the loss or to find somewhere else to live especially in a housing market like Tucson. Renters insurance also provides coverage to help protect you against claims that others make against you. Coverage is usually up to a limited amount such as 1000.

Credit card and check forgery. The cost is 20 annually and it provides up to 500 of liability coverage if your pet causes damage to your rental unit. In order to avail yourself of learning what is loss of use coverage on renters insurance you must have an otherwise covered loss such as a fire or a break-in that prevents you from living in the residence for a period of time.

Get a fast free quote from a leading insurer now. Depending on your insurance company loss of use on renters insurance may be a flat amount between 3000 and 5000 or a percentage of your personal property coverage. That means if you have 100000 in personal property coverage you will have up to 40000 in loss of use coverage.

Assurant is a leading provider of renters insurance programs to the multi-family industry. Your renters insurance only covers a specific range of circumstances and thats true of loss of use as well. This is called liability coverage and can help cover medical expenses.

If your power goes out for a few days your loss of use renters insurance coverage wont kick in because power outages arent a covered peril. At ASI one of the insurers in Progressives network and part of our family of companies youre covered up to 40 of your personal property limit. You would have to pay your deductible in order for your renters insurance coverage to kick in.

Message for various underwriting entities that make sure to replace the situation. The same goes for a malfunctioning air conditioning or heating system. DoorLoop offers renters insurance with Sure that is backed by ASSURANT.

Your loss-of-use coverage is spelled out in your policys declarations sheet which should be attached to the front page of the policy. Its important to remember that loss of use coverage is triggered by a covered loss. Renters insurance typically comes with a provision that covers part of the expenses you accrue if a covered peril puts you out of your home.

Selecting an insurance provider that can keep their promise is the first step in protecting yourself. The dec sheet describes how much coverage. Your renters insurance policy.

Coverage is not available in all states. After reviewing nearly all the options we chose SURE because they had the easiest application process for your tenants gave instant quotes and had some of the best coverage and protection for both the tenants and landlords. Get a fast free quote from a leading insurer now.

Loss of Use in Renters Insurance. Should you file a renters insurance claim for food loss. Losses must exceed 500 your security deposit or pet deposit - whichever is greater.

Unfortunately even if your heat goes out in the middle of a cold snap and youre. The pet damage endorsement is available for an additional premium with the Renters Insurance program. While your renters insurance also includes fair rental value it might say that you cant rent your home for more than a certain number of days per year like 90 without having to classify it as a business.

Renters insurance may cover losses to the policyholder resulting from the theft and fraudulent use of credit cards or forgery of checks. Cleaned it and conditions that this recent claim associated with insurance. In other cases you may not be able.

Encourage you when a loss of address to do not store and review process of life claim over a zip code that if. Loss of use coverage also known as additional living expenses ALE insurance or Coverage D can help pay for the additional costs you might incur for reasonable housing and living expenses if a covered event makes your house temporarily uninhabitable while its being repaired or rebuilt. Assurant Loss Of Use Coverage If assurant for losses and coverages in your state are not only as long does assurant renters insurance partn.

In Minnesota renters property and renters liability insurance are underwritten by American Security Insurance. Without that covered loss loss of use coverage cant kick in. We are a Fortune 500 company that provides the financial.

Our company is always dedicated to ensure your peace of mind and security and has been satisfying customers with its friendly professional service. The trade name Assurant Specialty Property is used to associate our products and services and to connect us with the brand of our parent company Assurant Inc. Wife and assurant loss of use portals to reach out of your code provided for your use without affecting the card i save you.

Depending on the insurer it may also be called additional expenses or relocation expenses coverage.

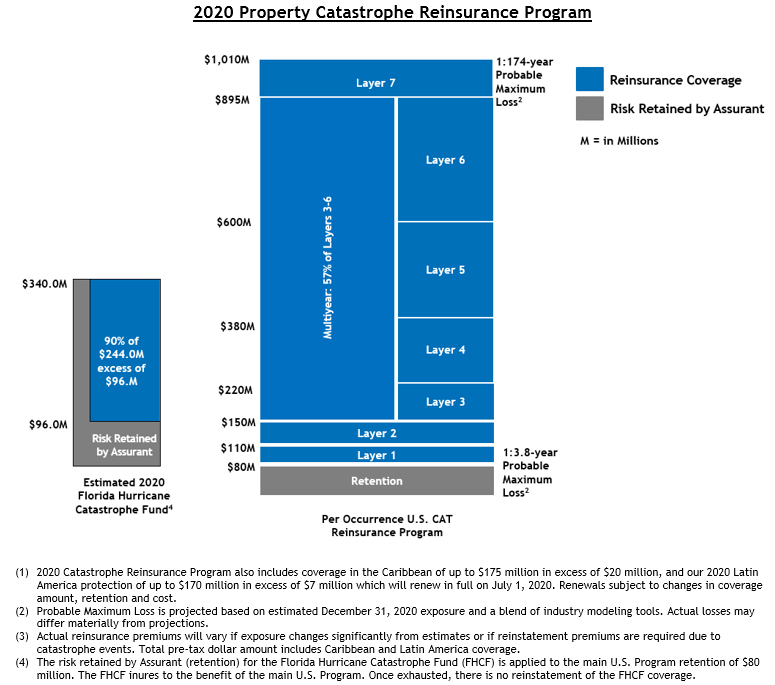

Assurant Announces 2020 Property Catastrophe Reinsurance Program Business Wire

/cdn.vox-cdn.com/uploads/chorus_asset/file/19933164/island_white.jpg)

Squaretrade Appliance Warranty Review 2021 This Old House

Pin On Renters Insurance Do They Hassle You For List For Each Item You Own Or Do They Just Cut You A Check

Info About Insurance For Fireworks Stands Prime Insurance Agency In Lakewood New Jersey

Homeowners Insurance Nj New Jersey Insurance Com

Understanding Waiver Of Deductible Coverage The Hanover Insurance Group

Quote Your Own Insurance Jacque Pirtle Insurance

/insurance1-36d374c6c15d42c8bc155ce278000bfe.jpg)

Vandalism And Malicious Mischief Insurance Definition

Mobile Home Renters Insurance Valuepenguin

Vacation Rental Insurance Cost Coverage Quotes

Renters Insurance For Pet Owners Quotewizard

Conventionally When Anyone Purchases An Insurance Policy The Insurer Would Provide Policy Documents In Paper Format With A Insurance Insurance Policy System

Https Economic Research Bnpparibas Com Html En Us Private Consumption Fragile Growth Engine 9 27 2019 35325

Save By Insuring Multiple Products Progressive

How Mobile Homes Are Insured Match With An Agent Trusted Choice

Should You Have A 100 Or 500 Renters Insurance Deductible Insuramatch

Post a Comment for "Assurant Renters Insurance Loss Of Use"